Introduction

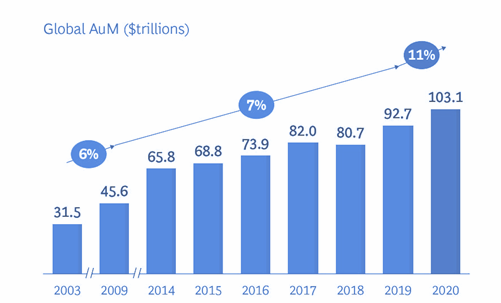

With the onset of the pandemic, the landscape of investment management has become Volatile, Uncertain, Complex, and Ambiguous (VUCA). As per recent reports, close to 10 million new retail investors have begun investing in the stock markets. Concurring with this raise, the Assets Under Management (AUM) worldwide increased to about $103 trillion in 2020, with North America contributing $49 trillion, almost half the global AUM.

Growth of Retail Investors

Retail investors were growing steadily even in the pre-pandemic world thanks to the emergence of easy-to-use trading platforms provided by online brokerages, attracting the younger generation of first-time investors. Post-pandemic, the newer retail investors are continuing their high volume of engagement, driving recent trends in the capital markets. In 2020, retail investors’ AUM was $42 trillion, an 11% growth compared to 2019.

Owing to the increase in investors and the AUM managed by firms, there is tremendous pressure to bring in stringent regulatory scrutiny to safeguard the interests of investors and management firms.

Regulation in Investment Management

Regulation is an integral part of the financial industry. The asset management industry is primarily governed by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Their regulations help mitigate vulnerabilities, maintain market stability, and establish fair market access.

For instance, the AML act mandates that advisers registered with the Securities and Exchange Commission (SEC) must establish AML programs, monitor customers’ high-risk activity, and report suspicious activities.

The actual cost of non-compliance

Complying with regulations is becoming an increasingly complex, cross-functional effort. It’s no longer a domain of just the Chief Compliance Officer or Risk Officer. Other CXOs roles also have critical parts to play in the planning and implementing regulatory compliance.

But often, the increasing pressure of dealing with a high customer base while adhering to the constantly updating regulatory rules lands firms into compliance failure.

For example, in August 2020, Interactive Brokers LLC – a leading brokerage firm in the US, was fined $38 million by regulatory bodies for widespread failure in the company’s AML program. The firm had insufficient compliance personnel and inadequate AML systems to monitor, detect and report suspicious transactions over five years.

The case stated above puts forward the question of why organizations are failing to adapt, despite increasing compliance mandates.

Implementing Regulatory changes – Key challenges

Usually, regulatory non-compliance happens because firms find it challenging to keep up with the ever-changing regulatory requirements. Regulatory change is a complicated affair for financial institutions. From the process to procedure, personnel, and technology, several components within the firms need to be revised to remain compliant.

Three major challenges faced by firms when implementing regulatory changes are:

- Implementation Gap – Regulatory requirements versus operational implementation

- In the past 5-7 years, especially post the 2008 crisis, regulatory changes have increased by 492%, which does not seem to be slowing down.

- A high volume of regulatory changes often leads to gaps between communicating the requirements and incorporating them into their existing systems.

- This gap in communication and incorporation leads to a delay in implementation, as numerous systems and applications need to be updated. In addition, systems are siloed across different departments, causing dependencies and longer implementation times.

- Redundant Operational Processes: Legacy technologies make it difficult to scale with the evolving regulatory needs.

- Legacy technologies need to be replaced, especially in the surveillance and monitoring of fraudulent activities. The traditional rule-based system is outdated and time-consuming as manual intervention is required to detect new patterns.

- The rule-based method also causes large volumes of false positives, leading to a costly investigation. Reports state that compliance personnel cost to identify and address these false positives account for more than 75% of compliance costs, whereas actual fraudulent activity goes unnoticed.

- Complex manual reporting :

- A study across investing firms found that 91% of investment managers reported that manual processes and spreadsheets affect the ability to control errors.

- Yet, respondents reported that manual processes persist across the back office. For example, across the 60 million back-office regulatory and investor reporting functions, at least a portion of the process was managed manually, resulting in operational risk, higher turnaround times, and repetitive and redundant activities.

Three key areas which firms are looking to address for efficient reporting are:

- Data consolidation

- Minimizing reporting errors and

- Improving data accuracy and consistency

How Analytics can help to achieve Regulatory Intelligence

With these impending challenges, asset managers realize that their response to increasing compliance requirements must be tactical and strategic. To minimize the impact on business and internal resources, they want an effective analytical solution, precisely curated to achieve regulatory intelligence. Data migration is a tactical initiative as firms are slowly moving towards the cloud to efficiently support the big data and analytics solutions to handle their regulatory operations.

Here are some areas where analytics can solve the challenges mentioned above:

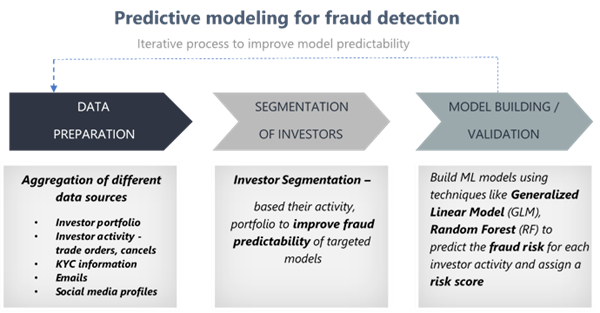

- Improving fraud detection using Predictive analytics

- Predictive analytics is a scalable alternative for the traditional rule-based models to detect fraud accurately.

- Predictive models can be trained to look for suspicious patterns in historical data, which is an aggregation of customer data and their activity and unstructured data from external sources.

- This data can be segmented based on customer behavioral characteristics, improving model accuracy. ML models can be built with this data using various modeling techniques and retrained via a feedback process to refine future pattern detection.

- These predictive models can be incorporated into the existing rule-based systems to assign a fraud risk score to the activities. This will help prioritize the cases with a higher-risk, hence freeing up time investigating low-risk ones.

These models will ultimately result in improved fraud detection accuracy by reducing the number of false positives and catching suspicious activity otherwise undetected by manual processes.

- Integrated Data Lakehouse on the Cloud

A data lakehouse combines data lakes and data warehousing concepts to combine and store structured, semi-structured, and unstructured data efficiently.

- Data lakehouse will serve as a centralized data unit, thus breaking down silos in the organization. This will reduce gaps in compliance by providing seamless integration between departments, thus reducing the long regulatory implementation time and cost.

- A consolidated data unit paves the way for a single source of truth. This will ensure data integrity, consistency, and accuracy.

- Easy enablement for BI tools and reporting. Analysts today spend 90% of their time on data collection and preparation

,only 10% on data analysis. A lakehouse will allow compliance analysts to derive meaningful and actionable insights from the reports rather than spending hours consolidating data for the same.

Conclusion

Today’s explosion of investor data is not only highly valuable to organizations from a strategic standpoint but also presents challenges in storage, management, and adherence to regulatory and legal requirements.

At LatentView Analytics, we provide support in developing an effective data governance program for the next-generation platforms, staged to manage/mitigate challenges, gain a competitive advantage in addressing current compliance issues, and scale to accommodate the increase in regulatory demand. Get in touch with us at marketing@latentview.com to know more.