A new financial year begins, and with the Union government’s Budget rules for FY25-26 of ample tax exemption, you would expect more money in your hands. This year, income up to ₹12 lakh is exempt, while the highest tax slab (30%) applies to those earning ₹25 lakh and above. The tax rebate has been increased to ₹60,000, theoretically putting more money into people’s hands. But does this mean you don’t pay any taxes? Not really, indirect taxes are applied to almost everything you buy. And it all adds up to become a significant chunk of your earnings.

Tracking the Invisible Expenses

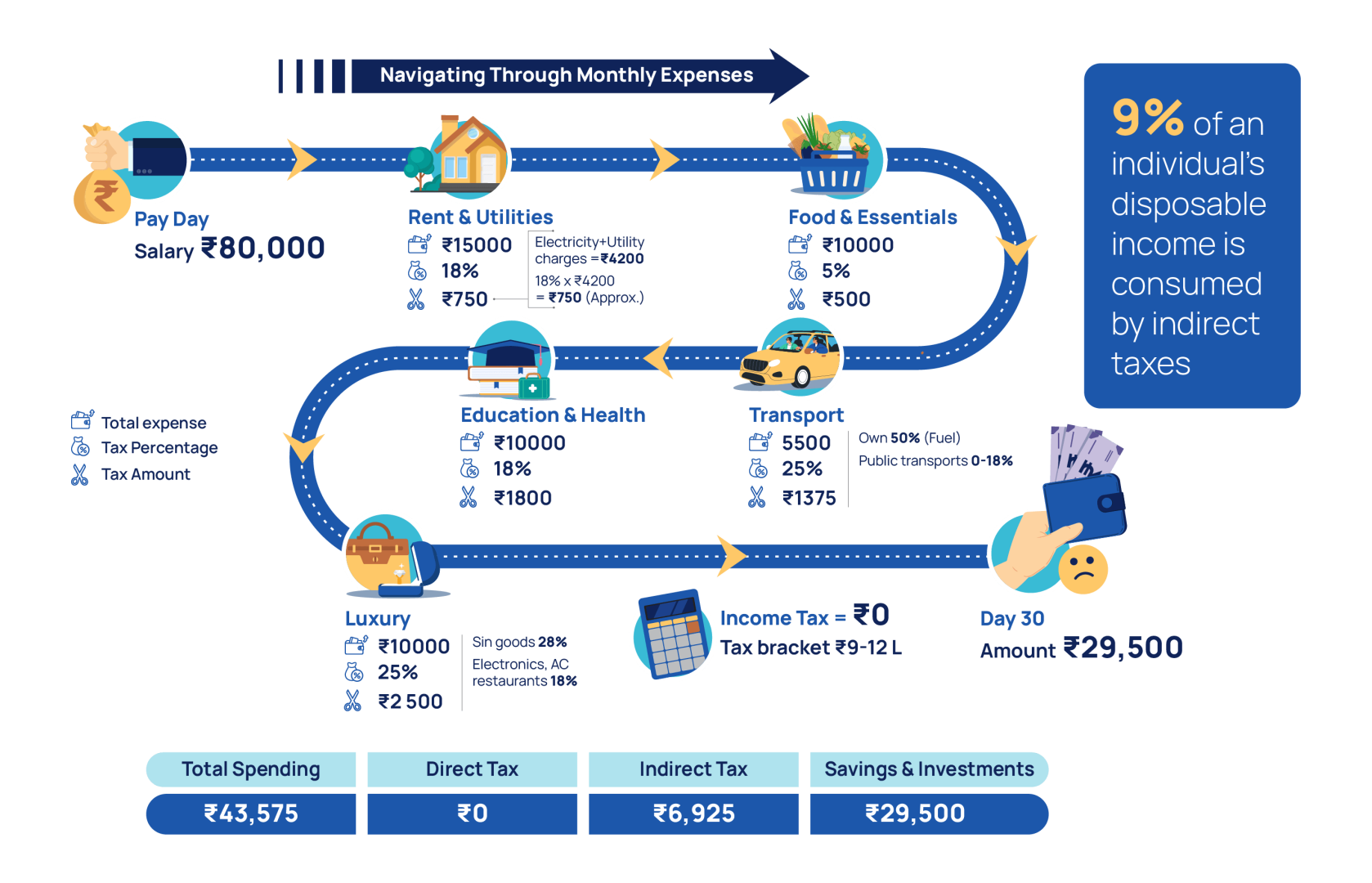

We analyzed the financial habits of a salaried individual earning ₹80,000 per month to understand the balance between savings, expenses, and taxation. Essentials like rent, groceries, education, and transportation contribute nearly ₹7,000 in indirect taxes each month — amounting to almost 9% of the household income.

Between 2016 and 2025, household expenses have risen by 15.7%, not just due to inflation but also because of a shift toward premium consumption. Consumer behavior indicates that people are prioritizing experiences over traditional savings. While this signals increased purchasing power, it also raises indirect tax contributions, making tax relief from direct savings less impactful. This creates a cycle where higher consumption fuels further taxation, impacting net disposable income in ways that are often overlooked.

What This Means for the Middle Class

While direct tax relief has been welcomed, indirect taxes have steadily increased. The government’s new approach seems to encourage spending rather than saving, helping to sustain the overall tax cycle.

Over the last decade, indirect tax rates have risen by 73.13%, keeping the overall tax burden relatively unchanged. Even with increased earnings, savings have decreased by 3%, showing that tax relief alone does not guarantee financial stability. Look at the table below to see the taxes applicable under the different categories over the years.

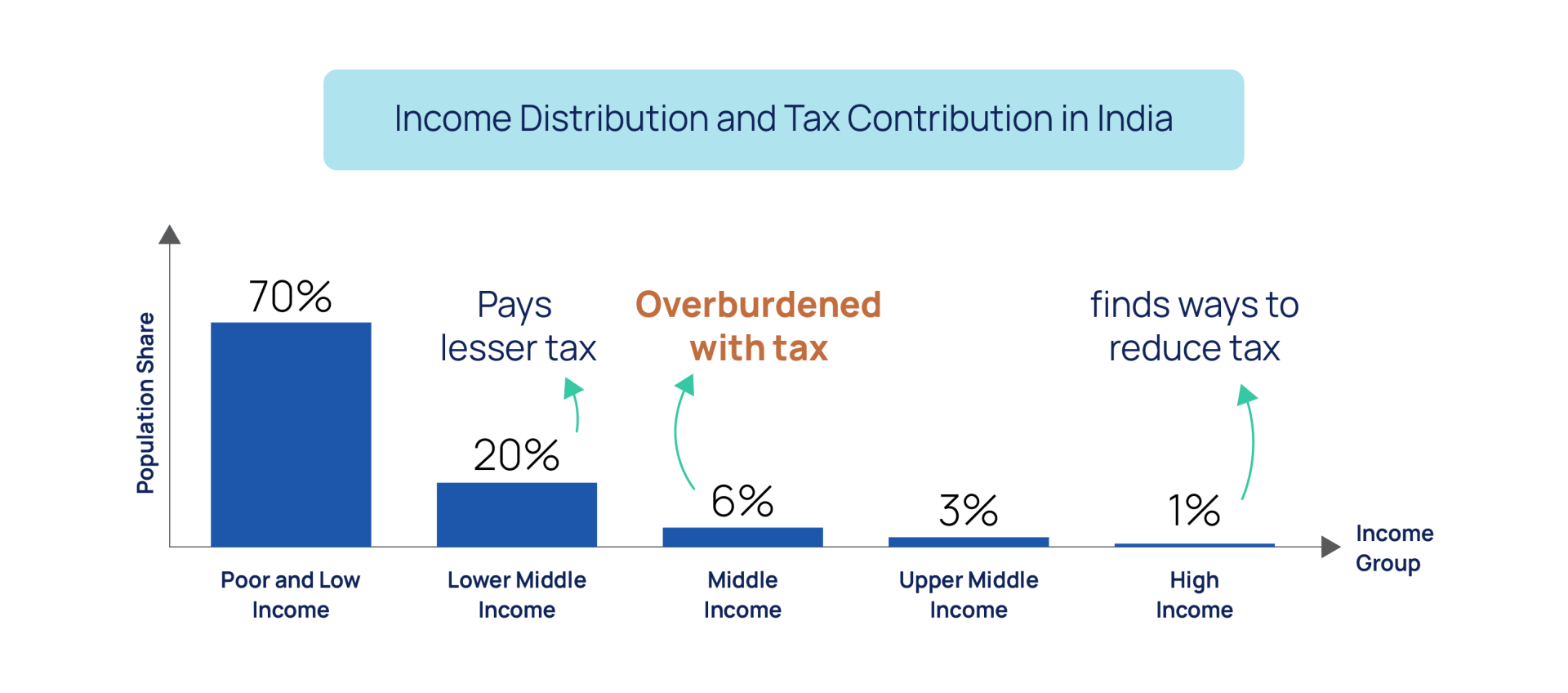

Unlike direct taxes, which are progressive and based on income levels, indirect taxes apply uniformly, regardless of how much you earn. This means a person earning ₹10 lakh per year and another earning ₹30 lakh pay the same GST rate on essentials or education and healthcare. For the middle class, this creates a disproportionate tax burden, subtly eating into the benefits of direct tax relief.

Rethinking Spending & Taxes

For many in the upwardly mobile middle class, earning more doesn’t necessarily mean saving more. A larger paycheck often translates to lifestyle upgrades—dining at premium restaurants, upgrading to a high-end smartphone, or taking an international vacation. Spending patterns are shifting from necessity-based consumption to aspirational purchases such as organic food, premium streaming subscriptions, or designer clothing — choices that enhance the quality of life. However, these choices come at a cost, as they increase indirect tax contributions, subtly reducing disposable income.

When indirect taxes disproportionately affect middle-income earners—limiting their financial mobility while wealth continues to concentrate at the top — it creates economic disparity that may, over time, erode trust in governance and policymaking. Aristotle argued that a broad and financially secure middle class prevents social unrest, while modern scholars like Professor Ganesh Sitaraman warn that a shrinking middle class can weaken democratic institutions. To strike a better balance, governments must ensure that tax policies promote both spending and saving. While indirect taxes are a key revenue source, measures such as differentiated GST rates for essential and luxury goods, rebates for first-time homebuyers, and tax incentives for long-term investments can help ease the financial strain on the middle class. Additionally, policies that encourage financial literacy and responsible spending habits can contribute to long-term economic well-being.