“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.” – Charles Darwin

If we had to pick one quality that helped sustain life and nurture growth in the process of evolution, then it must be the ability to adapt to change. To reiterate what Charles Darwin said, it is not always the strongest nor the intellectual that survives, but the one who is most adaptable to change survives.

The COVID-19 pandemic has disrupted almost every industry and has brought with it sweeping changes in consumer behavior. With the unemployment rate at an all-time high, the ability of consumers to pay for their purchases has reduced significantly. In such a scenario, how can companies/merchants sell their products? How can consumers buy a product without tightening their purse strings?

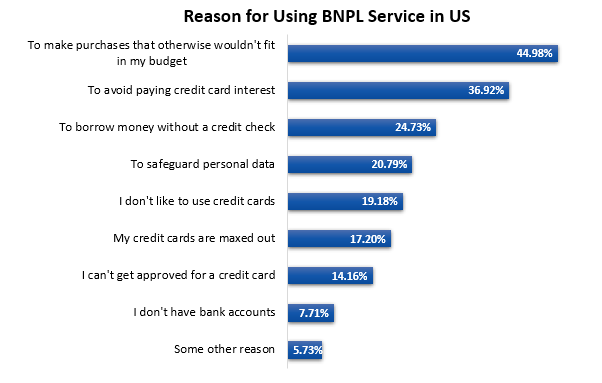

Well, the answer lies in a recent phenomenon called Buy Now Pay Later (BNPL). As a consumer, you buy a product now and pay for it later (even in installments). BNPL has been around for a while now but has gained traction during the pandemic. According to Forbes, at the end of March 2021, 56% of Americans had used BNPL for purchases, which is almost a 48% increase in less than a year.

Source: https://www.fool.com/the-ascent/research/buy-now-pay-later-statistics/

Rampant Growth Accompanied by Challenges

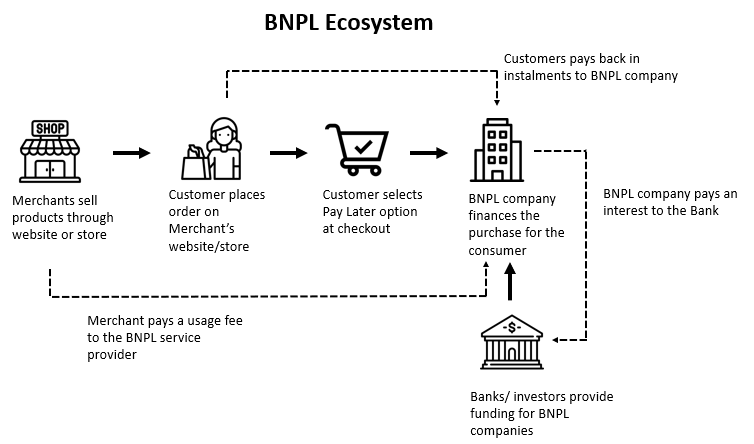

Even though BNPL has been a preferred payment option for the consumers during the pandemic and probably beyond, it comes with its own unique set of challenges, especially for BNPL service providers (companies). To know the challenges, let us first understand the process and the players in the BNPL ecosystem.

- BNPL Companies: These are companies that offer their customers repayment plans

- Merchants: These are enterprises that partner with BNPL companies to get paid for their goods & services

- Consumers: People who use BNPL installment plans to complete their purchase

- Bank Partners / Investors: These include large banks that provide funding for BNPL companies to pay to the merchants

So, Where Does the Challenge Arise?

When there is Merchant Failure

As highlighted by Equifax, COVID-19 has put many merchants at a greater risk of failure due to locally mandated lockdowns. Many merchants rely on access to emergency working capital via The Paycheck Protection Program (PPP) established by the CARES Act to stay afloat. According to Forbes, Coresight Research predicts 10,000 stores could close in the US in 2021 (14% increase from 2020). As of Jan 2021, there have been 1678 store closures, and in 2020 there has been an overall 8741 closures. This becomes problematic to BNPL companies if the Merchant owes funds to it.

When Consumers Default Payments

The prevailing high unemployment rate has impacted the consumers’ ability to pay back on time for their purchases. This becomes complicated for the BNPL company if consumers cannot pay back even with installments.

During Customer Acquisition and Engagement

With the new normal in place, there’s an opportunity to expand the merchant partnerships, customer base and improve the customer association. But maintaining the momentum of growth post-pandemic could become problematic if the engagement with the current set of merchants and customers are left unchecked.

The Way Out? – Analytics to the Rescue!

As per the same report by Coresight Research, it is estimated that US store openings could reach 4000 in 2021. Therefore, this can be viewed as an opportunity to use analytics to identify merchants/consumers with risks and avoid any partnerships with them and to identify potential merchants to improve healthy partnerships.

Below are some of the areas where we can use Analytics to mitigate the challenges identified above:

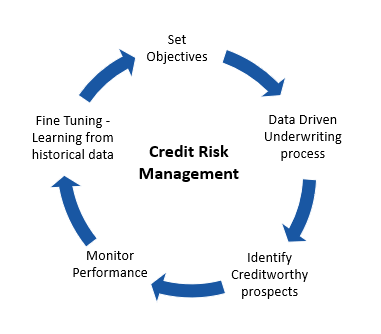

- Credit Risk Management:

- Analytics can be used to build an effective credit risk policy through a data-driven approach for the underwriting process that would help identify creditworthy prospects from an existing pool of customers and merchants. In addition, analysts can use the performance of the identified merchants and the customers’ repayment patterns to finetune the underwriting process further.

- Impact: Whitelisting creditworthy customers and merchants, optimizing credit limits, and incorporating learning from historical loss & charge off data to minimize future losses

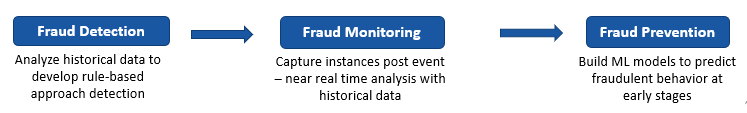

- Fraud Prevention:

- Fraud Analytics can be used to monitor, predict, and identify fraudulent transactions and prevent such transactions in the future. The process would involve gathering historical transactions data and mining it for patterns and abnormalities. For example, in the case of Merchants, the average order value, we can predict the loan growth to better comprehend the future sales for the Merchant. Analysis can also be done on dispute and refund rates to predict fraudulent transactions.

- Impact: Prediction of fraudulent behavior at an early stage results in better credit usage and minimum losses.

- Growth Strategy:

- Analytics can be used to segment, target merchants and customers based on their behavior and aid in customer acquisition. In addition, historical customer data can be used to cross-sell and upsell, thereby powering customer growth strategies.

- Engagement with customers can be improved through analysis on feedback from customers, sentiment analysis, customer loyalty, and lifetime value analysis.

- Impact: Better engagement with customers resulting in improved perceptions

The ability of BNPL companies to rethink, redesign and reinvent their policies would be instrumental in adapting to the new normal. The application of analytics would aid the BNPL companies in identifying the right merchants and customer groups to target and emerge victorious in the post-pandemic world.

LatentView Analytics – A Recognized Leader in Analytics

At LatentView Analytics, we have used analytics to help companies across a range of Financial Services. We provide analytics support for our clients in the areas mentioned above to drive and accelerate their business, mitigate challenges, and gain a competitive advantage. If you would like to know more about LatentView’s end-to-end custom analytics solutions, please write to marketing@latentview.com.