Demystifying AI: Connecting the Dots In The Real World

Excerpts from LatentView’s Eleventh Analytics Roundtable at New York (May 16, 2019)

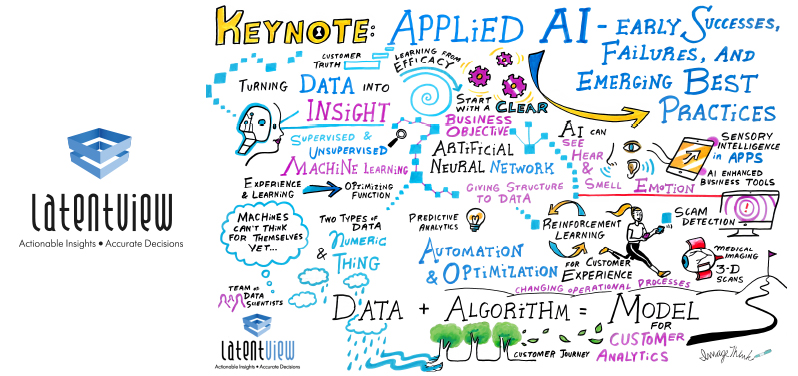

Keynote address: Applied AI- early successes, failures, and emerging best practices

Speaker: Brandon Purcell, Principal Analyst, Forrester

In an engaging and entertaining keynote, Brandon took the audience through an interesting journey to demystify AI. While getting everyone involved, he separated AI fact from fiction, shared interesting and innovative use cases and provided a framework to help determine where to apply AI not only for incremental gains, but to truly transform business.

Some interesting AI truths are its ability to see and hear emotion – and even to smell. AI use cases range from predictive maintenance on trains to helping banks identify customers that look bad on paper, but actually, have major wealth potential. AI is even being used to thwart email scammers (and enact a bit of poetic justice).

What’s the #1 blockade of AI adoption according to Brandon? Data. Accessing it from multiple sources and ensuring it’s clean. The key insights that encapsulate Brandon’s keynote: AI is not a silver bullet. There are early successful case studies, but also examples of failure when companies implement AI just because it’s a trend. Next, there are a lot of misconceptions about AI – from its definition to what it can actually do. Organizations must have knowledgeable partners or internal expertise to disambiguate AI. Finally, organizations need to take an ordered approach when jumping into AI. According to Brandon, these steps include:

- Define business objectives: What exactly are you trying to accomplish in both the short term and long term and what is the expected ROI.

- Engage relevant stakeholders early: Get buy-in from the top as well as all parties within the organization needed to make the project a success.

- Take thorough inventory of data: Have an understanding of where the data it is coming from and how it is being organized, stored, secured and leveraged.

- Select the appropriate AI technology, plan for action and evaluation: Having a proper plan in place ahead of each initiative is crucial. This includes choosing the right members of the organization to be involved, setting timelines, soliciting feedback, etc.

- Most importantly, measure success and communicate results to replicate across the enterprise – rinse and repeat.

Artwork created real-time at The Loeb Boathouse on May 16, 2019

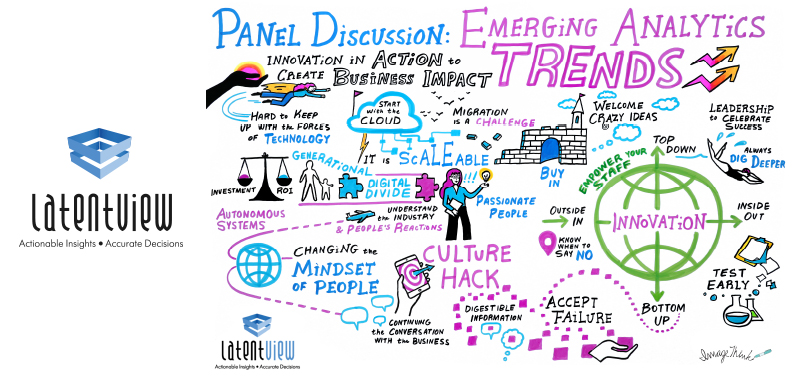

Panel discussion: Emerging analytics trends – innovation in action to create business impact

Justin Lahullier, Chief Information Officer, Delta Dental, Neeraj Arora, Former Head of Customer Analytics and Consumer Science, AIG, Doug Kushnerick, Technology Scouting and Ventures, ExxonMobil, Moderator: Sekhar Krishnamoorthy, Chief Product Officer, LatentView Analytics

In this panel, executives from Delta Dental, AIG, and ExxonMobil shared thought-provoking ideas around emerging analytics trends (including, but not limited to AI/ML), and ways companies can harness these trends to maximize business impact. The insurance and oil & gas industries are vastly different, but the panel agreed that consumer expectations are high, trends are fast moving and short-lived, and it’s a challenge for companies to place bets on the right tech today. Echoing Rajan’s opening remarks, a recurring idea was that people and culture need to be at the center of analytics-driven innovation.

Justin Lahullier from Delta Dental brought up ‘culture hacking’ and stressed the importance of keeping analytics firmly tethered to clearly defined business objectives. He shared how at Delta Dental, they put their data scientists through customer service training before anything else. Justin commented, “Our IT team members and data scientists need to understand our business and industry first and then figure out the analytics tool that is needed.”

Doug Kushnerick from ExxonMobil suggested the best way to spark innovation is to seek out business models and practices that the company has been slow to adopt through normal methods. For ExxonMobil, the challenge has been migrating from data systems considered cutting edge 40 years ago to new tech available today. When it comes to AI/ML, they’re experimenting – but always first ask how AI will change their business.

Neeraj Arora highlighted the theme ‘innovation in action’. He believes the way to foster better collaboration and innovation is to understand how people within a company will react to new things. An important step toward leveraging emerging trends for innovation is to create a culture of ‘incentivized experimentation,’ where people can feel comfortable sharing ‘crazy’ ideas…without being called crazy.

Artwork created real-time at The Loeb Boathouse on May 16, 2019

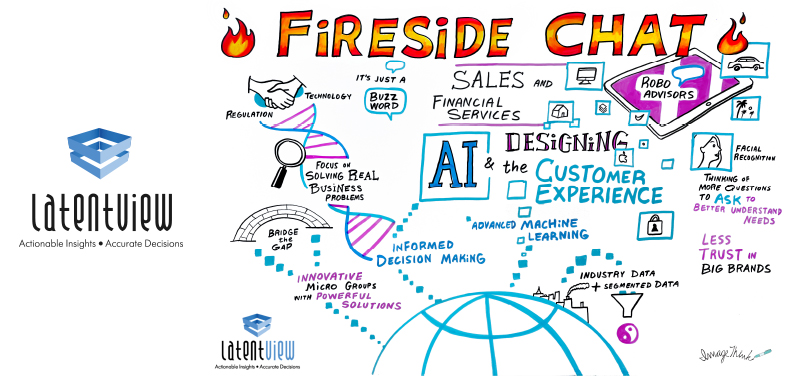

Fireside chat

Muk Mehta, Chief Information Officer, AssetMark and Farha Adeni, Director, Analytics and Data Engineering, LatentView Analytics

In a very interesting conversation under the larger financial services umbrella, Muk Mehta from AssetMark and Farha exchanged thoughts on how technology is disrupting and transforming an industry that’s highly regulated and traditionally slow to innovate. Muk touched on overarching challenges and limitations of AI adoption in the financial advisory space (e.g. robo advisors), but also some cutting-edge opportunities for AI – even the use of facial recognition so that advisors can gauge people’s emotional reaction to financial topics with the goal of providing a better client experience.

Muk believes that robo advisors will not make financial advisors obsolete (a wide-ranging fear about AI across many industries). There will however be a shift where AI tools help create better efficiencies, but not work completely independent from humans. When it comes to blockchain, Muk said that relatively smaller operations like AssetMark will likely follow and harvest learnings from what larger financial services firms are doing.

Commenting on the future of financial services and fintech, Muk said that it’s a tough industry for innovation, but recently VCs have focused on smaller, fast-to-market point solutions such as Robin Hood and Acorns. Looking further ahead, he predicts a lot of AI/ML innovation by smaller players that have gained consumer trust. He concluded that for the financial advisor industry to evolve, it needs new ways to bring data together between platforms and to leverage things like NLP and visualization technologies to better integrate data and align with customers.

Artwork created real-time at The Loeb Boathouse on May 16, 2019

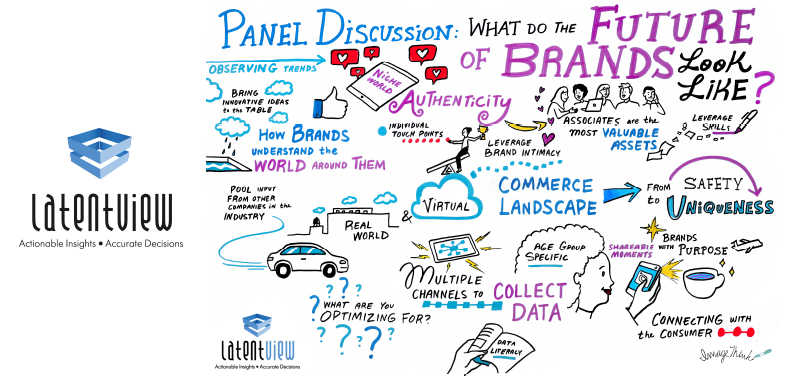

Panel discussion: What does the future of brands look like?

Andy Dratt, Chief Commercial Officer, Imbibe Inc., Manash Bhattacharjee, eCommerce Head of Product Management, PepsiCo, John Damalas, Sr. Director – Analytics, Walmart, Kumar Subramanyan, Director, Data Sciences, Unilever, Moderator: Shalabh, CPG Practice, LatentView Analytics

The second panel was interesting by design, as it included executives from companies spanning the entire consumer goods value chain – from concept, to production, to the retail shelf. Unilever rounded out this expert CPG panel that dove into a topic that’s top of mind for every consumer company: How can brands better understand consumers and the world around them? Everyone agreed that innovation has evolved from being episodic to real-time. Brands must leverage data to connect with consumers based on today’s trends, but also to predict trends and identify whitespace opportunities (who could have guessed we needed Starbucks’ Unicorn Frappuccino?).

Andy Dratt from Imbibe identified an interesting paradox today with the rise of smaller direct-to-consumer brands. Big brands from the past benefited from very little consumer distraction. However, smaller brands have the power of niche social media audiences that drive targeted engagement. That being said, engaging with consumers is one thing, getting your product to them is something else. Access to supply chain is something big brands enjoy. So in many ways, big brands want to be like small brands and vice versa. Regarding analytics, Andy stressed the importance of using data to predict what’s next vs. only looking back to copy what already worked.

Manash Bhattacharjee from PepsiCo said that for them, it’s all about using data as an asset to understand consumers. Today, data is enabling brands to launch products faster than ever. The future of brands is agility – the ability to launch a product, use consumer data to fine-tune and keep iterating. This seems daunting but is necessary as consumers increasingly want to buy an experience, not a product. What does this mean for the organizational structure of a CPG company? At PepsiCo, Manash is seeing different teams come together to create new cross-functional teams to solve these challenges.

According to John Damalas from Walmart, the opportunity for them and other brands lies with a much richer landscape of data, both online and in-store. The challenge is that a lot of data is unstructured and hard to measure (how do you measure experience or preference?). With many small brands in Walmart’s portfolio, they face the same challenge that Andy mentioned: balancing brand intimacy with scale. What’s next? John believes the power of data analytics will help brands know exactly what option to give to every individual customer to provide the best experience.

Kumar Subramanyan from Unilever echoed the thoughts about consumers looking for more experiences and touched on how brand loyalty has changed with GenZ. On one hand, consumers want to be unique, but also inclusive. This makes it hard for brands to segment audiences for products that are both personalized but don’t exclude others. Getting this right requires R&D processes to change and organizations to remove information asymmetry. According to Kumar, AI will play a bigger role in spreading information across organizations.

Artwork created real-time at The Loeb Boathouse on May 16, 2019