Understanding AI in Financial Services

Artificial Intelligence (AI) has changed every facet of modern industries, primarily by mirroring human cognitive abilities in data analysis, pattern recognition, and assistance in decision-making. Likewise, in the BFSI sector, AI has significantly impacted operations, making financial institutions rethink fraud detection, customer service, risk management, financial forecasting, and more. But what is artificial intelligence in financial services? And how is it bringing all these changes? Let’s break it down.

Running day-to-day financial operations involves labor-intensive routine tasks, complex evaluations, and manual management of communications with customers and stakeholders. Typically, these requirements drain employees, impacting productivity and leading to limitations in operational performance. AI has the potential to chip away at these problems and position financial institutions on a strong footing. By implementing an amalgamation of advanced technologies like Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP), and more, AI in financial services expedites processes, eliminates bottlenecks, and optimizes operations.

Why is AI Essential for the Financial Service Industries?

A report on the rise of AI adoption estimates that AI in finance surged from 45% to 85% in the time span of just three years. This drastic implementation denotes AI’s imperative nature in the sector. Here’s a quick rundown on why AI is necessary in today’s financial services:

- The diversity of the volume of financial data is vast and growing. To handle this effectively, financial leaders need technological assistance. AI-driven applications prove to be transformative in this case. By empowering stakeholders with the capability to synthesize huge amounts of data, AI in finance delivers insights for decision-makers, helps identify operational gaps, and forecasts financial outcomes.

- In a world where instant gratification is the norm, financial services are no exception. Customers today demand swift, seamless, secure, and personalized engagement in all their operations. To cater to that, banks and other institutions are turning toward AI-powered chatbots for customer support, knowledge interfaces, and client servicing.

- Bank of America has deployed ERICA, a virtual financial assistant that interacts with customers to answer their queries, provide recommendations, and guide them in their operations. ERICA is available 24/7 x 365 to assist in smarter financial operations, which have improved client interactions exponentially.

- The financial ecosystem is constantly subjected to strict regulations and is always under scrutiny for security, privacy, and accuracy. To manage expectations and tackle regulatory challenges, financial organizations are always on the lookout for tools with enhanced capabilities. Using AI in financial services simplifies and augments the approach to security and compliance. With solutions such as AI-Driven Fraud Detection, AI-Powered Regulatory Compliance, Financial Risk Management, and more, organizations can protect themselves, comply with regulatory requirements, and provide a frictionless experience to their customers.

- Maximizing profit and minimizing operational costs at the same time is a top priority for all banking & financial services providers. In order to achieve that, organizations need to automate high-frequency tasks and focus their resources on other value-driven initiatives. AI-powered automation can be a great addition to automating core banking or other processes. With applications such as automated claims processing, customer onboarding, loan application management, report generation, and so on, AI-enabled automation can save significant time and cost in overall operations.

- JPMorgan Chase adopted AI-based automation to optimize document management, which has been instrumental in saving operational time and resources that demanded manual reviews.

Key Components of AI Impacting Financial Services

Now that we have explored the critical role of artificial intelligence in financial services. Let’s dive deep and discern the core elements of AI that contribute to its expanding capabilities:

Machine Learning

ML is a subcategory of AI that can learn and make predictions from a given set of data. Within financial operations, ML is used to analyze data, detect patterns, and make predictions. Its real-world applications include credit scoring, fraud detection, and risk analysis. By utilizing ML techniques such as random forests, neural networks, and regressions for discerning patterns out of datasets, ML algorithms are of great help in data-driven decision-making.

Deep Learning

DL is a type of ML that specializes in neural networking. It employs a layered approach for in-depth data analysis by extensively analyzing data sets and recognizing patterns from them. Some of the real-world use cases of DL include Algorithmic Trading, Market Forecasting, and Financial Risk Management.

Natural Language Processing

NLP is a subset of AI that is responsible for discerning human languages. By understanding and recognizing languages, NLP interprets and responds to queries. NLP is central in chatbots, AI agents, and conversational bots when it comes to capital-rich ecosystems such as financial services. NLP augments operations by understanding customer queries, regulations, compliance, and more.

Apart from these technologies, some other notable mentions are Predictive Models and Computer Vision (CV), which are also used as part of artificial intelligence in the financial services sector.

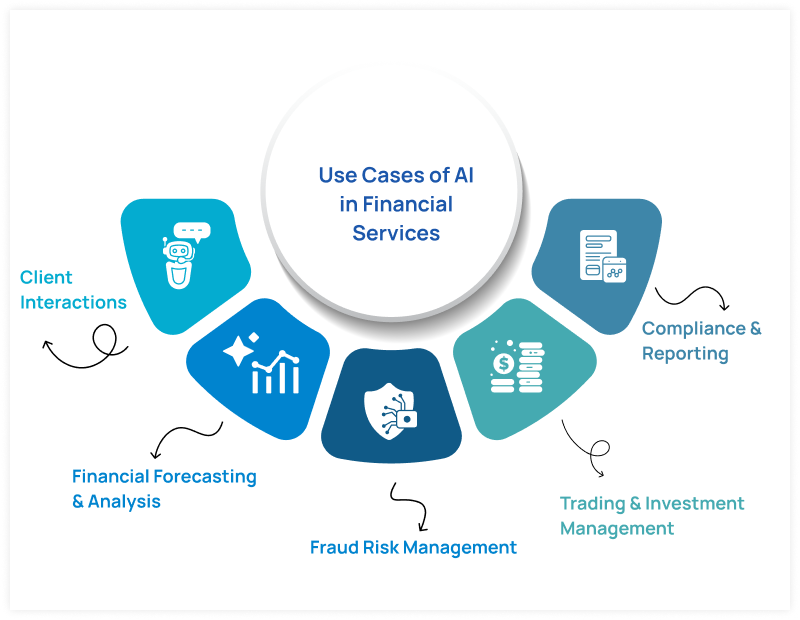

Use Cases of AI in Financial Services

As an early adopter of AI, the finance industry has explored various applications to optimize an array of business functions. Here are the key use cases with examples:

Client Interactions

The rise of conversational AI, agentic AI, and chatbots has radically changed how financial institutions pursue customer interactions. With the capability to swiftly and efficiently assist customers round-the-clock, this AI-based approach has reduced friction for institutions and increased accessibility for its customers.

Example: Barclays has deployed AI-powered customer service agents to provide seamless 24/7 customer support, which has reduced request processing time, standardized procedures, and improved accessibility to banking services.

Financial Forecasting & Analysis

Forecasting in financial planning and analysis is of utmost importance in the banking, finance, and insurance sectors. Through in-depth analysis of historical data, AI enables organizations to predict the future, which helps in operational optimization and alignment. Currently, forecasting is used across functions like budgeting, allocation, and operational management in the BFSI sector.

Example: Emirates NBD integrated GenAI-based predictive analytics to unlock new growth opportunities, refine business processes, and provide enhanced services. This has amplified their operations and improved productivity.

Fraud Risk Management

One of the prime applications of AI in the finance industry is its ability to detect fraud, mitigate risks, and prevent mishaps. By constantly analyzing customer behavior, AI and advanced algorithms can detect anomalies and flag them for deviations. Organizations largely use by capability to prevent various types of fraud, money laundering, and other risks.

Example: HBFC has embedded an AI-driven solution to keep a check on financial crimes. With a vast number of transactions processed on a daily basis, this solution supports them in proactively detecting threats and protecting their operations from evolving fraud risks.

Trading & Investment Management

Artificial intelligence in financial services, particularly for investment firms, is bringing massive value in terms of smarter operations and upscaling. With algorithmic trading, firms are embedding AI to trade with real-time data that aligns with current market trends. This approach drives their investments and helps them make strategic decisions.

Investment firms like BlackRock, Wealthfront, and Goldman Sachs are using AI-powered solutions for trading and investments. These firms are actively embedding AI to identify opportunities, manage risks and volatility, and make informed decisions.

Compliance & Reporting

The integration of artificial intelligence and financial services has led to major advancements. With AI-based automated reporting and compliance tools, institutions can report suspicious activities to regulators, adhere to compliance, and align their operations with regulatory requirements.

Commonwealth Bank, a prominent Australian bank, has strengthened its compliance stance by using AI-based solutions, leading to improved outcomes. Additionally, the bank also uses AI-powered solutions for documentation and reporting, which has been a significant support in their auditing endeavors.

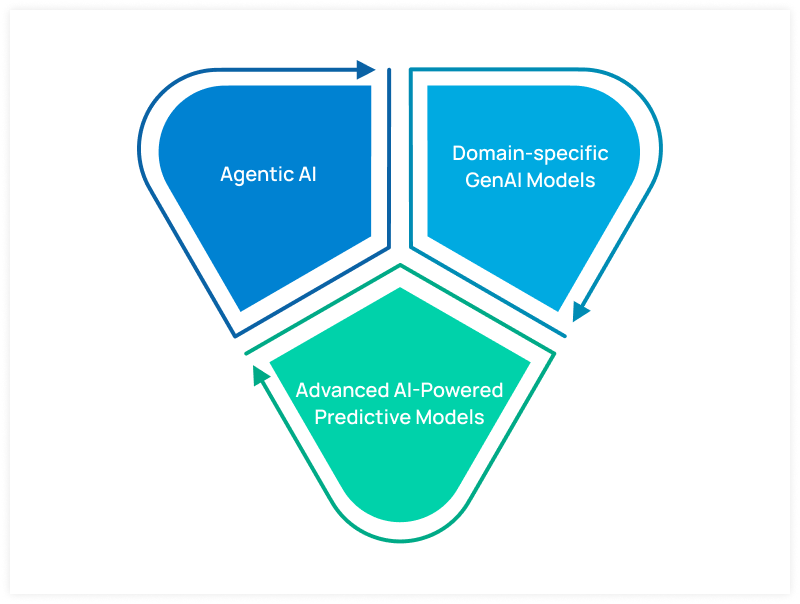

Emerging Breakthroughs of AI in the Financial Services Industry

Financial organizations that have implemented AI report a staggering 18% increase in their ROI. This indicates the transformative benefits that AI for Financial Services offers. Let’s quickly understand some key advancements that are redefining the financial service industries and how they can impact the future of the sector:

Agentic AI

This emerging technology is the newest and most advanced form of AI combined with large language models (LLMs). Agentic AI addresses the limitations of traditional AI and improves upon it. Unlike conventional AI, this can analyze data, set goals based on the analysis, and take necessary actions with limited human intervention. Agentic AI in the BFSI sector has a wide range of applications, such as automatic portfolio management, risk management, fraud prevention, and more. By using its dynamic ability to solve problems and make decisions, Agentic AI can completely change the course of operations.

Domain-specific GenAI Models

Generative artificial intelligence models in the financial sector are the need-of-the-hour solutions. As GenAI models evolve and present their usability, they can be leveraged to solve operation-specific challenges. Pretrained particularly on financial data and iterated based on requirements, these models reflect reliable and accurate outcomes. For the BFSI sector, these advanced GenAI models are especially useful in financial analysis, optimization, and management.

Advanced AI-Powered Predictive Models

These are solutions with advanced ML algorithms that use intricate computational techniques to make predictions. Central to its capabilities, these are used for analytics and decision-making purposes. Some major applications of these models are in customer churn prediction, risk scoring, financial assessments, etc.

Dilemmas for AI Adoption in the Finance Sector

Despite these outcomes, they are hesitant to implement AI in financial services. With rising concerns about data security, governance risks, biases, and inaccuracies, organizations find it challenging to capture the benefits of these emerging technologies. Even though the early momentum of AI promises significant potential, organizations are caught between the crossroads of embracing the technology and navigating its risks. Overcoming these complexities can be challenging, but with strategic alignment, the high-stakes financial sector can move beyond limitations and explore the true possibilities of AI.

Catalysing Financial Transformation with LatentView Analytics

LatentView Analytics is a renowned leader in business analytics solutions that guide enterprises toward AI-led transformations. Trusted by industry leaders worldwide, we facilitate end-to-end AI & Analytics solutions that unlock exceptional value, growth, and new opportunities.

With discipline-specific expertise in the finance sector, LatentView offers an array of solutions for financial services, including:

- Marketing & Customer Analytics

- Risk & Fraud Analytics

- Insurance Analytics

- Platform Modernization

Offering analytics and AI for financial services, our extended capabilities include intelligence for Fraud Risk management, budgeting, forecasting, customer value analysis, hyper-personalization, investment management, cash & liquidity management, and more. Additionally, we have proprietary in-house solutions like PRISM and LASER, which have been developed to enhance the security posture and deliver advanced business insights to financial industries.

If you’re keen to reimagine your financial processes, get next-gen insights, and deliver tailored customer support, connect with our expert at LatentView to explore possibilities.

Future of AI in Financial Services

As financial institutions increasingly embrace the potential of AI and analytics, the future unveils exciting prospects. Looking ahead, we can anticipate targeted automation for specific business functions, enhanced security for operations, personalized banking experiences, augmented financial advisory, and much more.

Industry leaders also predict that the next shift in banking and financial operations will be solely powered by AI and other emerging technologies that are going to disrupt the domain like never before. These advancements will empower the sector to be more efficient, insightful, and innovative.

The Final Word

AI in finance industry is making strides in transforming the sector by modernizing its capabilities. With the core objective of simplifying accessibility and adaptability, AI is poised to change financial operations, customer interactions, and financial management. By adapting to rapid AI intervention, the BFSI sector continues to find opportunities to achieve stronger financial performance and augment its operations.

Unlock the Power of AI in Finance, Drive Strategic Growth.

Connect with our experts to learn more.

Unlock the Power of Generative AI to Transform Your Analytics

"*" indicates required fields